" It's usually great to purchase something that's a bit newer so you don't have to stress as much about maintenance," says Poteete. That does not indicate it needs to be a big home in the fanciest community just something that will not need a lots of labor. To reduce threats such as an extreme modification in the real estate market, a deficiency of reliable occupants, your liability if somebody hurts themselves on your residential or commercial property, or any other predicament, you ought to acquire the home through a LLC to safeguard your individual properties. Liquidity is the ability to turn your financial investment into money. When thinking about how to begin purchasing property, ask yourself what you are utilizing your financial investment for and how rapidly you need to turn an earnings.

There are two primary methods property investments earn money. The very first is producing money circulation. This type of financial investment starts generating income in the very first month and delivers consistent income. This would be your finest strategy if you require to make short-term revenues that will put money in your bank account right now for things like saving up for a down payment on your dream home or settling debt, like credit cards or student loans. Money flow from realty financial investments originates from rental properties and renting your own home. The other way to earn money from real estate investing is home gratitude, or the increase in value of a house over an amount of time.

This avenue is for those financiers who are willing to wait on returns. The alternatives for gratitude investing consist of both buying your own house or a rental property to then offer when its value has considerably increased. When buying a rental residential or commercial property to offer later and rent out in the interim, you're making both a short-term and long-lasting financial investment. According to Home, Light's Top Representative Insights from the 2nd quarter of 2019, "The Core, Logic House Rate Index report found that house prices increased 3. 6% year-over-year in April 2019 and projects prices to increase by 4. 3% in 2020." Multi-family homes with two to four units make 18% of the country's rental housing stock and, in 2019, averaged 2.

This is another benefit for investors who rent these kinds of residential or commercial properties. Source: (Kim Wooters/ Death to the Stock Picture) If you're a realty investment beginner, there are low-risk, effective options for newbies. One perk of not having lots of funds to begin investing with is that the majority of your alternatives are fairly low-stakes and low-risk. You can begin from the bottom nearly immediately with fast returns. How to find a real estate agent buyer. If you wish to dip your toe in the property investing pool, these are the very best entry-level alternatives to think about: This might include a visitor room, basement or carriage house; you can share the typical locations with your tenant.

How To Start Investing In Real Estate - An Overview

This is a low-risk choice to start producing money circulation for instantly available funds, to help cover the cost of your mortgage, or to put into savings for your next financial investment. This is basically the like the above alternative, other than you will be responsible for cleaning up after guests (you can charge a housekeeping cost to cover this) and setting up for new guests. As an Airbnb or Vrbo (an acronym for holiday rental by owner) host, you have control over what part of your house to lease and when, whether that be just part of your house so you don't need to leave during the guests' stay, or the whole house that you leave when guests are present on weekends, during the summer season, or whenever you can leave.

These are independently traded REITs. There are some caveats to think about with this alternative, which include the truth that many of these apps charge fees varying from 1% to 2. 5% of their customers' managed possessions; though it's fast to begin, these apps can take a long period of time to produce significant returns; and the dividends from these investments may be taxed. Let's state you made your extremely first realty investment and completely squashed it. The bug bit you and you desire more! Well, fortunate for you, there's always more opportunities to be had. Have a look at where to go when it's time to make the dive from novice to intermediate.

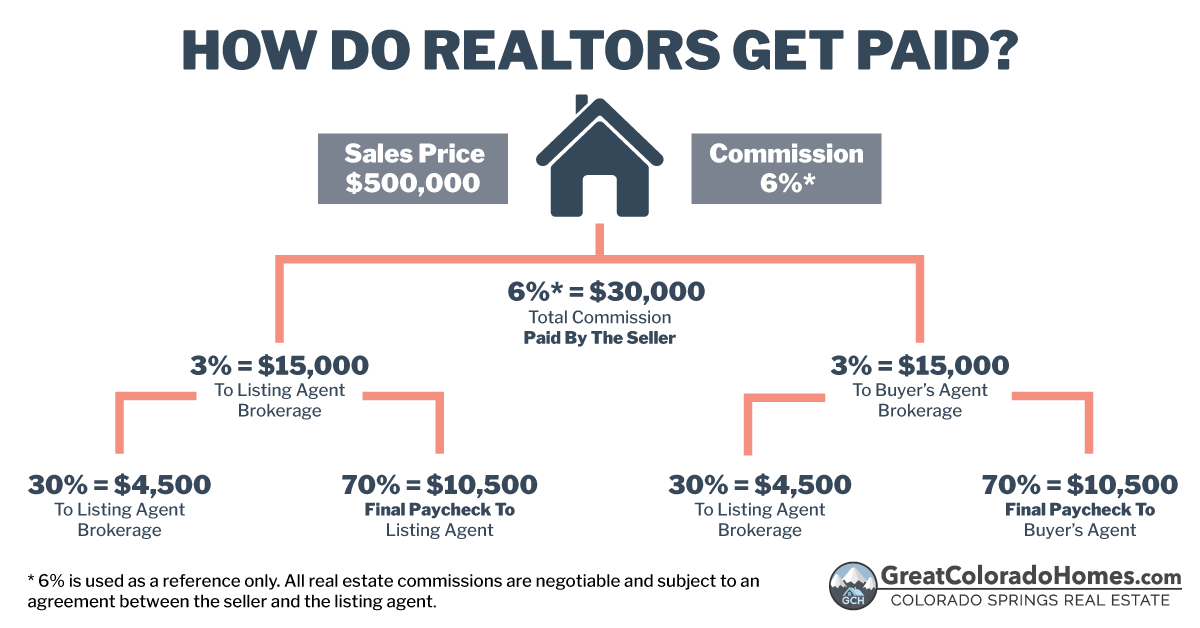

This can be achieved in two methods: investors can buy a house specifically to rent to occupants, or they can purchase a multifamily property where they reside in one unit and lease the others, likewise called house hacking. How does a real estate agent get paid. The former choice requires a minimum of a 20% deposit and an financial investment mortgage, which includes higher rate of interest than primary owner-occupied home loans approximately 0. 5% to 0. 75% more. The latter option, depending upon the rate of the home, can be more cost effective because it can be purchased for just 3. 5% down with a FHA loan because it likewise functions as the buyer's primary home.

Investors can buy private business stock through a mutual fund or exchange traded fund (ETF) of the stock exchange. ETFs do not need a $3,000 minimum financial investment, and the minimum financial investment for personal REITs can range anywhere from $1,000 to $25,000. REITs perform well for long-term dividends however are bad short-term alternatives. Source: (Mark Winfrey/ Shutterstock) When it's time to finish to the property investment big leagues, where can you go next? Here are the next-level realty investment opportunities to keep in your back pocket for when the time comes. Buying houses that are below market worth, typically since they require a little or a great deal of TLC, and after that repairing them approximately resell or turning them is quite on trend right now.

Get This Report on What Do Real Estate Brokers Do

Returns on this type of financial investment can also be high, with the 2018 timeshare calendar most benefit ranging from 60% approximately 95% in certain metro areas. The most lucrative locations have the earliest real estate, thus more fixer-upper competitors. You do not have to be Chip and Joanna Gaines to rock the fixer-upper video game. You just need to know how to discover these investment gems, says Poteete. "Of course everyone wishes to buy a house 30% listed below market price, but there are only many of those residential or commercial properties out there, so you simply need to be really smart in your search. So that actually comes down to a financier who is willing to pound the pavement (How to buy real estate with no money down)." She says finding them is the trickiest part.

" Once you discover them, fixing them up and selling them is simple. Realty representatives are terrific at assisting you offer them." The next step to grow your real estate financial investment portfolio is disneyland timeshare rentals to purchase more properties if you can pay for to do so comfortably, utilizing the equity from the first residential or Click here for info commercial property to assist money the next one. "You still need to put 20% down, but you have the ability to roll a few of your equity from your other residential or commercial properties into these brand-new loans, and it can really help you have the ability to collect more in a little amount of time," says Poteete.